Temporary residents are issue to precisely the same tax rates as inhabitants and acquire other tax concessions.

No thesis is needed. Nonetheless, students who have an interest in completing a major writing task under the supervision of the college member may well do so by enrolling while in the Tax Seminar course (TX 982).

Being an instrument of federalism, the U.S. Constitution plays an important position in defining point out and native governments’ taxing powers. In some cases this is achieved by Categorical Constitutional provisions; in Some others, by express or implied grants of authority towards the legislative, government or judicial branches of government. This Superior condition and local tax course will examine and assess Constitutional provisions that Restrict (and from time to time grow) point out and native taxing powers. It is going to contain a historical review of Supreme Court docket jurisprudence that underscores the inherent complexities and tensions precipitated with the intersection of federalism and the underlying ambitions embodied within the Commerce Clause, Equal Safety Clause, Import-Export Clause, Privileges and Immunities Clause, and Supremacy Clause, among the Some others.

If you abide by our information and it seems to become incorrect, or it is actually misleading so you create a miscalculation Subsequently, we will acquire that into account when identifying what motion, if any, we should get.

to just take cognizance, possibly Individually or through their representatives, of the need for the general public contributions, to comply with it freely, to stick to its use and to determine its proportion, foundation, assortment and duration

During your time at BU, you'll be guided and supported by an entire-time associate director for professional growth devoted entirely to non-JD vocation troubles. The affiliate director will aid you in identifying chances, making ready for interviews, and presenting yourself for the US legal sector.

There are numerous courses that a applicant can find after the completion from the DTL course. This certificate course makes it possible for a prospect to go for equally further more training and position sectors. There can be a number of opportunities that are available inside the non-public and federal government sectors. Possess a think about the jobs and salary bundle for DTL.

Deductions are not permitted for private bills or People of the capital nature. However, if specified disorders are satisfied, it is achievable for companies and individuals to established off losses against other types of income.

As per the consumer’s economic place, fiscal advisors prepare the fiscal objectives for them and assist them to meet the aim.

There can also be numerous tax incentives for capital financial investment and inbound investments to Australia that could utilize in certain situations to get a constrained period of time.

The instructor is good. The course content is exhaustive and all initiatives are taken to cover all appropriate material.

Yes! Coursera provides money help to learners who would want to full a course but are not able to pay for the course payment.

With online courses and both equally total-time and part-time enrollment possibilities, the MLST system may be customized to fulfill your demands.

This zero-credit rating move/fall short course is designed to provide students with an understanding from the basic principles of finance and accounting in an effort to boost their study of tax or business legislation. The course is intended to provide students with little or no prior track record in finance and accounting with an introduction to the Main concepts, the critical vocabulary, plus the basic tools of both of these website subject matter regions.

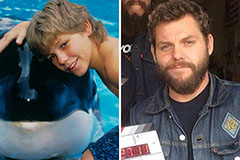

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!